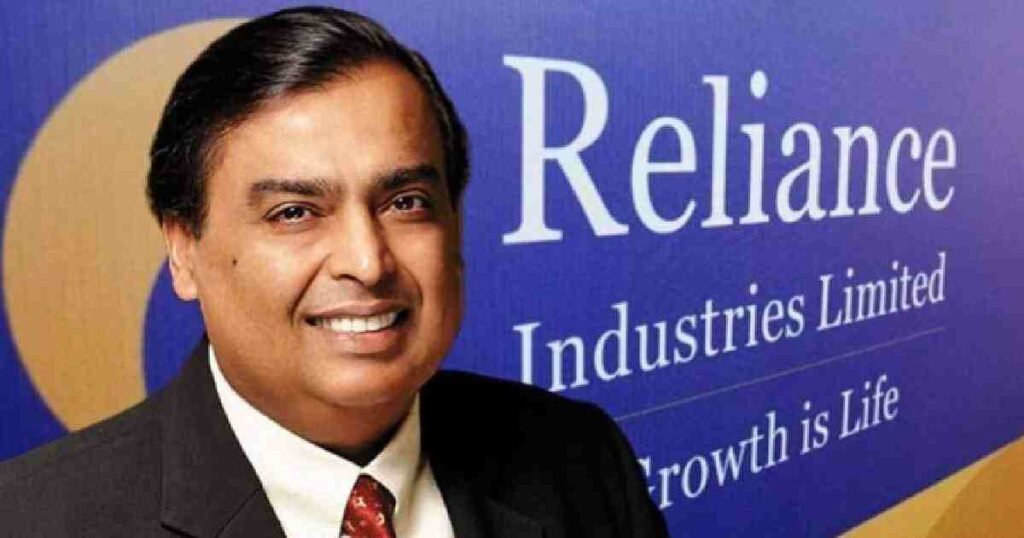

New Delhi, UNB, Nov 09 – Rumours are doing the rounds in India that the country’s richest man Mukesh Ambani may soon split his USD 200 billion business empire among his three children.

Mukesh, if the rumours are to be believed, is planning to hand over three core business areas of his oil-to-telecom conglomerate Reliance Industries to Akash, Isha and Anant, the younger generation.

What lends credence to the speculation is Mukesh’s aggressive fundraising spree to make his conglomerate debt-free amid the pandemic and his strategic decision to radically reduce Reliance’s dependence on the flagship oil sector to diversify into telecom and e-commerce.

“This strategic shift in business areas gives the biggest indication of a dynastic transfer. And making the company debt-free will give an edge to Mukesh’s children to expand their empire in years to come,” says Delhi-based economist Nayana Singhal.

Reliance had, in fact, raised USD 15.2 billion by selling stakes in its telecom unit Jio and another USD 7 billion through rights issue just in the first quarter of this fiscal that saw the shares of the conglomerate hitting an all-time high during the Covid-induced slowdown.

Moreover, Saudi Arabia’s Public Investment Fund recently announced its intention to buy a two percent stake in Reliance’s retail arm for USD 1.3 billion. Also, the world’s biggest crude producer Saudi Aramco is eyeing a 20% stake in its oil business for USD 15 billion.

Mukesh, in fact, has already helped twins Isha and Akash raise their profiles in the family-run business. Since their appointment to the board of telecom arm Jio six years ago, they have been addressing investors at annual shareholder meetings and rolling out products.

Isha, a Yale University alumnus who has previously worked with McKinsey as a consultant, had also played a key role in Reliance’s e-commerce entry into fashion retail in 2016 by launching online shopping portal Ajio, apart from her active participation in the Jio board.

Jio has attracted some 370 million subscribers to its network since its mega launch in 2016, despite being a late entrant to India’s telecom sector. By offering free voice calls and data at the world’s cheapest price, it has already changed the country’s digital landscape.

UNB had earlier reported about Reliance’s plans to take Jio public in the second half of the next fiscal, riding on the increased digital adoption across the world, including in India, in the wake of the Covid pandemic. India’s internet users are likely to grow to 850 million by 2022.

“Not only Isha, Akash, an economics graduate from Brown University, is also qualified to take over the reins. If the twins look after the retail and telecom units, the oil business could be bestowed upon by Mukesh on their 25-year-old younger brother, Anant,” Singhal says.

Anant had worked at Reliance’s Jamnagar plant earlier, according to the company’s annual report, which also says he is now on the board of Digital Services, the vertical which holds all the digital interests of the group, apart from being on the petrochemicals vertical.

Apart from planning to take Jio to the bourses, Reliance is also in talks with a number of fast moving consumer goods companies in this country to deliver daily-use domestic essentials at the doorsteps of consumers via Jio’s e-commerce venture JioMart.

Facebook’s chat service WhatsApp has tied up with JioMart to make consumers connect with local groceries to buy products. And if the talks with these FMCG giants fructify, market watchers believe the entire move will change the face of India’s e-commerce space forever.

India’s e-commerce market is estimated to touch USD 200 billion by 2027. This assumes significance given WhatsApp has already got permission to launch an e-payments service in India and Facebook bought a 9.99 per cent stake, by investing USD 5.7 billion in Reliance.