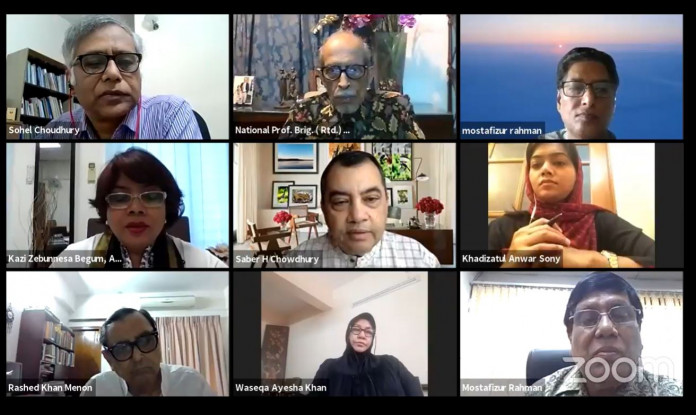

Dhaka, May 3 : Describing the current tobacco tax structure as extremely complex, speakers at a webinar on Monday urged the government to simplify the tax structure to widen its net in the country.They also said the complex tax structure is a major obstacle for discouraging tobacco usage at the virtual exchange meeting titled ‘Way Forward to Tobacco free Bangladesh by 2040: Tobacco Tax” with the members of the Executive Committee of the Economic Reports’ Forum (ERF) organized by Dhaka Ahsania Mission (DAM).

The speakers said Bangladesh is one of the most tobacco consuming countries in the world. In this country the price of cigarettes is very low, bidi is cheaper.

According to the Bangladesh Bureau of Statistics, the per capita national income (nominal) has increased by 25.4 percent in 2017-18 as compared to 2015-16. However, the price of most cigarettes has remained almost unchanged or has increased slightly. As a result, cigarettes are becoming more readily available. That is why, it is important to increase the price of cigarettes in a proper way, that is, through a specific tax increase.

The Project Coordinator of Tobacco Control Project at Dhaka Ahsania Mission Md Shariful Islam presented the keynote paper at the seminar while its Media Manager Rezaur Rahman Rizvi moderated the function.

In the keynote paper, the proposal for cigarettes in the financial year 2021-2022 was to introduce a specific excise (supplementary) duty based on the price level of all cigarette brands with uniform coverage (supplementary duty 65% of final retail price).

It suggested fixing the retail price of cigarettes at TK 50 per 10 sticks and imposing a specific supplementary duty of TK 32.50 at the low tier.

At the middle tier, the retail price of every 10 sticks of cigarettes is to be fixed at TK 70 and a specific supplementary duty of TK 45.50 is to be imposed.

At the higher level, the retail price of 10 sticks of cigarettes is to be fixed at TK 110 and a fixed supplementary duty of Tk 71.50 and at the premium tier, the retail price of 10 sticks of cigarettes at Tk 140 and a supplementary duty of Tk 91 is to be fixed.

In the medium term (2021-22 to 2025-26), the price and tax gap between cigarette brands will be reduced from 4 to 2.

Director of Health and Wash Sector at Dhaka Ahsania Mission Iqbal Masud said tobacco is linked to six of the eight leading causes of preventable death worldwide. In Bangladesh, more than 161,000 people die every year from diseases caused by tobacco usage.

Some recommendations that came up in the seminar on tobacco control are:

Reduce the easy availability of tobacco products, specific supplementary tariffs must be increased regularly in line with inflation and income growth.

SImplify the taxation process, the existing divisions/variety/tiers between tobacco products need to be removed. All smokeless tobacco products should be brought under the tax net.

Formulate and implement a simple and effective tobacco tax policy (for a period of 5 years) which will contribute to the reduction of tobacco usage and increase in revenue and the re-imposition of 25 per cent export duty on tobacco products.

Dr Syed Mahfuzul Haque, National Professional Officer (NCD), World Health Organization (WHO), Abdus Salam Mia, Grants Manager, Campaign for Tobacco Free Kids Bangladesh, Md. Mostafizur Rahman, Lead Policy Advisor, Campaign for Tobacco Free Kids Bangladesh, Sharmeen Rinvy, President of Economic Reports Forum (ERF) and SM Rashedul Islam, General Secretary of ERF also were present there, reports UNB.