Scores of prominent doctors have urged the government to hike tobacco tax in the budget to protect public health.

Scores of prominent doctors have urged the government to hike tobacco tax in the budget to protect public health.

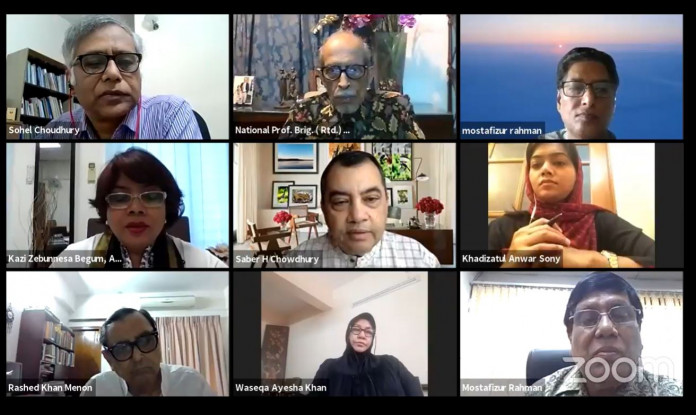

Describing the current tobacco tax structure as extremely complex, speakers at a webinar on Monday urged the government to simplify the tax structure to widen its net in the country.

The National Board of Revenue (NBR) has turned down the request of Dhaka Club Limited to stop activities of realising Tk 33.74 crore as Value Added Tax (VAT) and Supplementary Tax.

তথ্য ও যোগাযোগ প্রযুক্তি প্রতিমন্ত্রী জুনাইদ আহমেদ পলক সৃজনশীল অর্থনীতি ও জ্ঞানভিত্তিক সমাজ বিনির্মাণের স্বার্থে এবং ডিজিটাল বিপ্লব আরো এগিয়ে নিতে ইন্টারনেটকে বিলাসী সেবা হিসেবে না দেখে একে বিদ্যুৎ ও জ্বালানির মতো মৌলিক জরুরি সেবা হিসেবে গণ্য করে ইন্টারনেট যন্ত্রপাতির ওপর ভ্যাট ও শুল্ক প্রত্যাহারের আহ্বান জানিয়েছেন।

The National Board of Revenue (NBR) has extended the deadline for income tax return submission up to December 31.

The High Court on Sunday issued a 5-point directive to collect all kinds of due revenues, including value added tax (VAT) and tax, from internet based companies including Facebook, Google.

The government has planned a series of programmes to enter a new era of taxation from 2020-21 FY in the run-up to achieving Vision 2041 and reaching the Sustainable Development Goals 2030.

By Djaffar Shalchi COPENHAGEN, May 28 2020 (IPS) – For the past few decades, many big corporations and very wealthy individuals have operated according to the myth that they are “self-made”, that their success owed nothing to anyone else.

The National Board of Revenue (NBR) on Sunday asked its field offices to formulate a strategy keeping in mind the present condition and expedite the collection of Value Added Tax (VAT) and thus achieve the revised revenue collection target. “We’re…

Dhaka, May 07 – The Cabinet on Thursday cleared the drafts of two amendment ordinances in a bid to ease provisions in the collection of Value Added Tax (VAT) and income tax during a situation like the ongoing coronavirus crisis.

DHAKA – Prime Minister’s Private Industry and Investment Adviser Salman Fazlur Rahman today hinted reducing the tax rate in the next national budget for 2020-2021 for expanding the trade and business across the country. “The government is thinking to expand…

The wealth tax proposals advanced by Democratic US presidential primary contenders have drawn vehement criticism from many who should be supporting them.

Dhaka, Oct 26 (UNB)- Urging the government to save the poultry sector of the country, feed industries owners on Saturday demanded the withdrawal of five percent advanced tax on import of raw materials of poultry and fish feed.

US internet giant Google has agreed a settlement totalling 945 million euros ($1.0 billion) to end a tax dispute in France under an agreement announced in court on Thursday. The company will pay a 500-million-euro fine for tax evasion, as…

Dhaka, Aug 16 – The National Board of Revenue (NBR) of Bangladesh has taken an initiative to introduce a mobile application and a software, aiming to check the cases of tax evasion and increase the number of taxpayers.

Dhaka, July 22 – The National Board of Revenue (NBR) earned Tk 2,412.63 crore in the last two fiscal years by disposing of some 345 revenue-related cases through the Alternative Dispute Resolution (ADR) system.

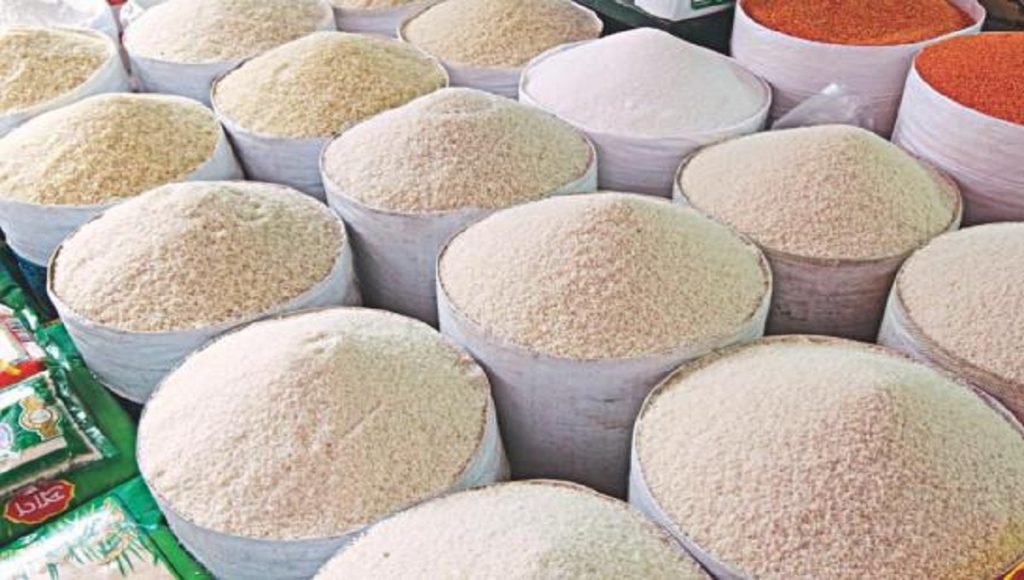

Dhaka, May 22 (UNB) –The government has increased the regulatory duty on rice import to 25 percent from the existing 3 percent, aiming to discourage its import following a drastic fall in rice prices in the country. The National Board…

Saudi Arabia’s Ministry of Finance has denied plans to tax the remittances of foreign workers. The statement to Saudi Press Agency came in response to reports of a proposal to tax transfers, the ministry said. “The Ministry of Finance denies…

India has scrapped its 12% tax on all sanitary products following months of campaigning by activists. The announcement comes a year after the government introduced the tax, known as GST, on all goods – including the 12% duty on menstrual…

The UAE Cabinet has adopted a law to roll back the application of a 5 per cent value added tax on the gold, diamond and precious metals market. State news agency WAM said the step was intended to maintain the…

Saudi Arabia’s General Authority for Zakat and Tax (GAZT) has announced that all lease contracts that were concluded before January 1 are exempt from VAT. The announcement affects assets that were delivered under leasing or rental deals last year including…